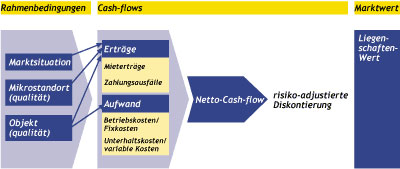

The basic idea behind Discounted Cash Flow evaluation is that the current market value of real estate is determined by the sum of all net income expected in the future (=net rent income, without auxiliary costs minus operating, upkeep, and repair costs), which is discounted according the current point in time. Discounting rates are adjusted to market conditions based on changes in ownership and capital market developments. Actual net income gained in the past is in fact important and valuable for specifying levels and trends, but it does not flow into the evaluation mechanism. All of the expected income (cash in) and all expected expenses for the property (cash out) is forecast over a span of ten years. The difference between expected income (cash in) and cash out results in the so-called net cash flow per period. The net cash flow per year is then discounted by a risk-adjusted discount rate. The discounted residual value is added to this in the eleventh year. This results in the market value as a sum of net cash flow across years 1 to 10 and the "technical sales value", which is calculated from the expected cash flow situation in the eleventh year.

Additional information:

Risk-adjusted discounting

Modern profile theory has shown that the higher the income (discounting rate) is, the more risk can be expected by the investor. In this context, we are referring to risk-adjusted discounting rates. We attempt to apply the discounting rate that corresponds with that of the average rational market participant. When determining this value, risk elements and aspects such as property characteristics (condition and standard), micro-location (location within the community/quarter) and the community or the quarter itself play an important role.

Market situation

The market situation is specified by factors such as reachability, tax risks, number of employment positions, market size, vacancy rates, and future opportunities.

Micro-location (quality)

Factors: environmental attractiveness, pollution, and situational particulars.

Property (quality)

Factors: Construction-related attractiveness, condition, standard, and usage flexibility.